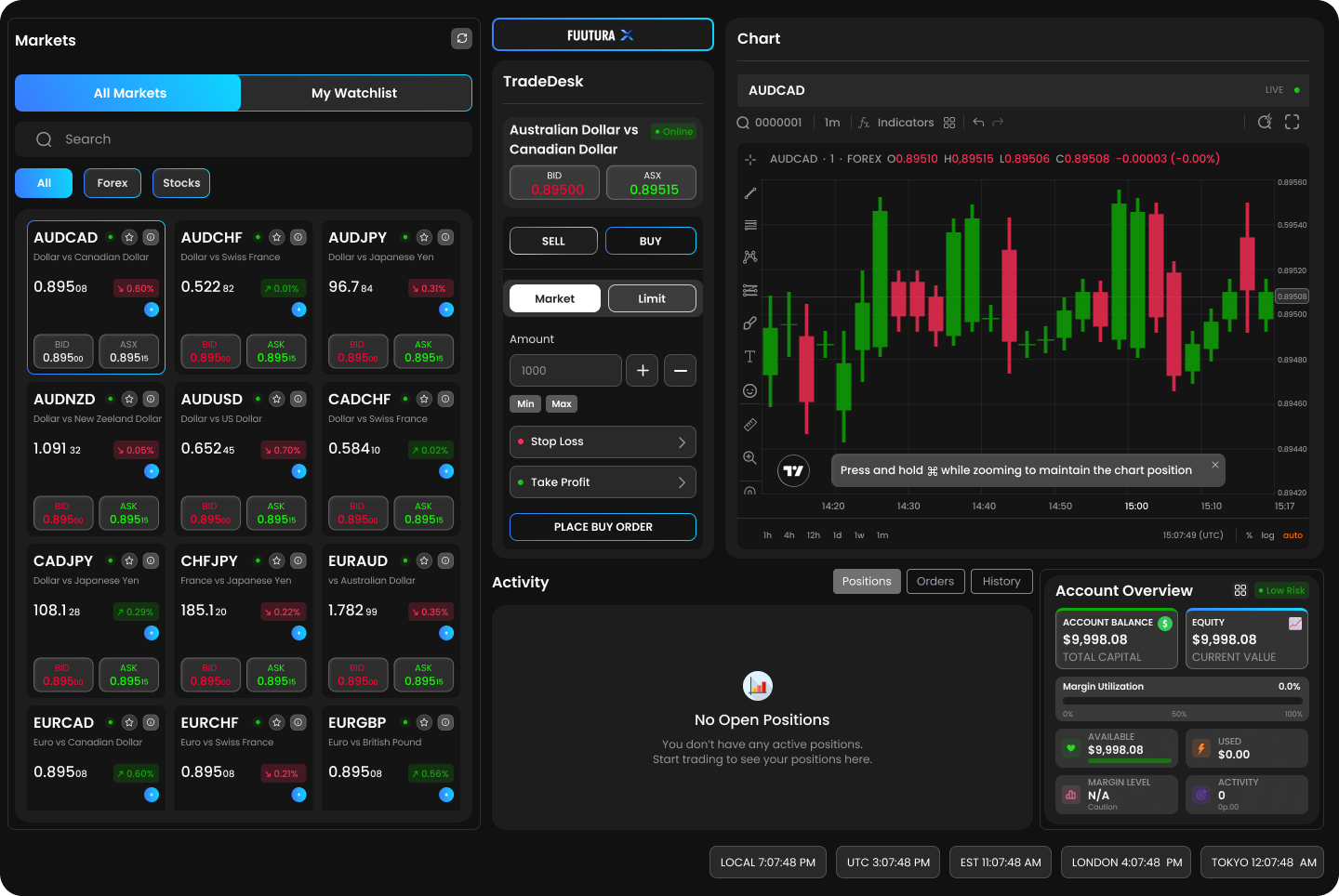

Fuutura is an exchange-first platform designed to modernise access to markets in a responsible, regulation-aligned way.

Access to markets remains fragmented, expensive, and operationally inefficient — particularly in emerging economies. Participants are forced to navigate. This creates friction, limits participation, and constrains market growth.

Multiple Platforms

Disconnected Payment Rails

Opaque Execution

Unclear Custody And Risk Exposure

A unified trading platform designed to deliver secure access, transparent execution, and scalable market infrastructure in one place.

A single execution layer built to support multiple asset types. Designed to deliver consistency, performance, and operational simplicity.

Access to digital assets and tokenized instruments. Connected to regulated markets, subject to required approvals.

A single execution layer built to support multiple asset types. Designed to deliver consistency, performance, and operational simplicity.

Efficient capital movement in and out of markets. Structured for operational clarity, reliability, and control.

Fuutura is an exchange at its core.

All supporting systems exist to enable this design allows the platform to operate sustainably across market conditions.

Trades are processed securely with strong safeguards at every step.

Designed to align with evolving regulatory and compliance standards.

Infrastructure that grows seamlessly with volume, users, and markets.

Rather Than Pursuing Growth Through Incentives, Leverage, Or Short-Term Optimisation, Fuutura Is Designed To Scale Through Trust And Participation.

Fuutura is designed to minimise custodial risk and improve transparency. By reducing balance-sheet exposure and improving asset visibility, the platform supports

Fuutura brings execution, payments, and market access together into a single, unified platform.

Trades are executed with precision, speed, and full clarity, ensuring users always understand how and when their orders are filled.

Every action, flow, and outcome is fully visible and traceable, removing opacity and building long-term trust.

Built on robust, compliant infrastructure that meets the operational, regulatory, and scale demands of institutional participants.

Emerging markets represent significant demand for accessible, lower-cost trading infrastructure. Fuutura sits at the intersection of:

Fuutura is not built to chase trends. It is built to become market infrastructure.